Granny Flat and Small Spaces Boom

Understanding Granny Flats: A Guide for Maximizing Returns on Residential Zone Property.

What are Granny Flats and How Can They Help You Maximise Returns on Your Residential Property?

Granny flats, also known as secondary dwellings, are self-contained units that are secondary to the main property on a single block. These dwellings have separate entrances, bathrooms, kitchens, bedrooms, laundry areas, and living spaces. Granny flats have become increasingly popular in recent years due to their affordability and potential to generate rental yield.

Granny flats can be constructed using a variety of materials, including shipping containers, which can offer a cost-effective solution for those on a budget. However, it’s important to note that council approval is required for the construction of a granny flat.

One of the primary benefits of a granny flat is that it can provide an affordable rental property for tenants, which can help to increase rental yield for the property owner. Additionally, a granny flat can also serve as a great option for multi-generational living, providing a separate living space for elderly family members or adult children.

If you own a residential zone property, building a granny flat can also help to maximise returns. Refinancing your property to fund the construction of a granny flat can be a smart financial decision, as the rental income generated from the secondary dwelling can offset the cost of the loan and potentially even provide additional income.

Maximising Returns With Granny Flats and Second Dwellings.

Granny flats and second dwellings are becoming increasingly popular as property owners look for ways to make the most of their space and maximise their returns. Whether you have a large backyard that you want to put to good use or a small parcel of land that you’re not sure what to do with, there are income and project ideas that could be the answer to your property’s potential.

For those who are new to the idea, a second dwelling is a separate self-contained unit built on the same property as the main dwelling. Granny flats, in particular, have been gaining popularity due to their relatively low cost and versatility. They can be used as rental properties, accommodation for elderly relatives or adult children, home offices, or even man caves.

The Australian Government Sustainable Homes website.

One of our clients, for example, built a dual-style second dwelling on a grassy backyard. One side was rented out, while the other was used as his man cave and home office. Another client built a second dwelling for his father, who needed to downsize from the family home. The family home was rented out, and the rental income was shared between the father and son.

If you’re thinking of building a granny flat or second dwelling, it’s important to do your research first. The first step is to call your local city council to ask for guidelines on building a granny flat or second dwelling. They will be able to provide you with information on the zoning and building requirements for your area.

There are also a few online resources that you can use to help you get started. The Australian Government Sustainable Homes website is a good place to start, as it provides information on sustainable building practices and energy-efficient homes. The Brisbane City Planning Guidelines also have a helpful fact sheet on granny flats and you may need to find the equivalent state guidelines to start your research.

When it comes to designing your granny flat or second dwelling, there are a few things to keep in mind. First, you’ll need to decide on the size and layout of your dwelling. One clever build is the 5×4 Hayes Lane Project in Melbourne, which is a 3-level build on a small block of land 5 metres by 4 metres squared. It’s important to note that the size and layout of your granny flat or second dwelling will depend on your local council’s guidelines and building requirements.

Another bit of detail to consider is the potential rental yield of your granny flat or second dwelling. You can use online calculators, to help you estimate your borrowing capacity and potential rental income.

Building a Granny Flat: Regulations, Design, and Maximising Returns

Granny flats are becoming increasingly popular among homeowners looking to maximise returns on their residential properties. These self-contained dwellings offer a great way to generate rental income, accommodate aging parents or adult children, or create extra space for guests. However, before you jump into building a granny flat, it’s important to understand the regulations that govern their construction and design.

Regulations for Building a Granny Flat

To build a granny flat, you must first ensure that your property is eligible. Granny flats can only be built on Residential Zone property and must be located on a single block with a primary dwelling. The block must be at least 450m² and the owner of the granny flat must also be the owner of the primary dwelling. Additionally, each residential property is limited to one granny flat, which cannot exceed 60m² of living space (although patios, verandas, or carports can be attached in addition to that allowance). Granny flats cannot exist on strata title, subdivided, or community title property, and cannot be built on unoccupied land or on a property used for commercial purposes.

Designing Your Granny Flat

Once you’ve confirmed that your property meets the regulations, it’s time to start thinking about the design of your granny flat. The best design will depend on your individual needs, but there are some key considerations to keep in mind. A well-designed granny flat should be comfortable, functional, and easy to maintain. It should also have clear, separate, and unobstructed pedestrian access to ensure safety and convenience for tenants. When it comes to the layout, it’s important to maximize space and prioritise privacy. This might mean including separate entrances, soundproofing, or private outdoor spaces.

Maximising Returns

Finally, if you’re building a granny flat with the intention of generating rental income, it’s important to think about how you can maximise your returns. One way to do this is by selecting affordable materials and finishes that will keep your construction costs low. Additionally, consider including features that will appeal to potential tenants, such as air conditioning, built-in storage, or outdoor spaces. It’s also a good idea to think about rental yield when designing your granny flat. This refers to the income generated by the property as a percentage of its overall value. By keeping rental yield in mind, you can ensure that your granny flat is generating as much income as possible.

To maximise your returns on your investment in building a granny flat, consider the following design tips:

- Utilise natural light to create an open and inviting space

- Consider installing sustainable and energy-efficient features, such as solar panels, to reduce utility costs and attract eco-conscious renters

- Use durable and low-maintenance materials, such as shipping containers or modular designs, to minimise upkeep costs

- Plan for storage solutions to maximise space and improve functionality

- Ensure the design meets council approval and consider hiring a professional architect or builder to ensure compliance with local regulations.

Refinancing Your Property

Finally, if you’re building a granny flat to generate rental income, you may want to consider refinancing your property. Refinancing involves replacing your existing mortgage with a new one that has better terms, such as a lower interest rate or longer repayment period. This can help to free up cash flow, making it easier to cover the cost of building your granny flat and generating rental income.

Remember, it’s important to speak with a credit adviser (mortgage broker) to determine if refinancing is the best option for your individual situation for the construction of a Granny Flat or secondary dwelling.

How to Build a Granny Flat and Maximise Returns: A Guide for Potential Borrowers.

As the demand for affordable rental properties in Australia continues to rise, building a granny flat can be an excellent investment opportunity for property owners. City councils have revised their town planning guidelines, allowing property owners to build a second dwelling on their residential zone property with council approval. In this guide, we will discuss how to build a granny flat and maximise returns.

A title

Image Box text

Before embarking on your granny flat project, it is essential to have a clear understanding of your budget and design ideas. There are various options available, ranging from the traditional low-set home to the prefabricated modular style, and the pricing will vary accordingly. You can visit the granny flat finder website to explore design ideas and get started.

One of the main advantages of building a granny flat is the lower cost compared to building a new low-set home. While the traditional low-set home can cost between $1,500 to $4,030 per square meter, a second dwelling can cost as low as $1.200 per square meter. If you are on a tight budget, you can also consider building a granny flat using shipping containers or a kit-style home. However, you need to factor in the transport fees, and a shipping container may not have the same aesthetic appeal as a traditional granny flat.

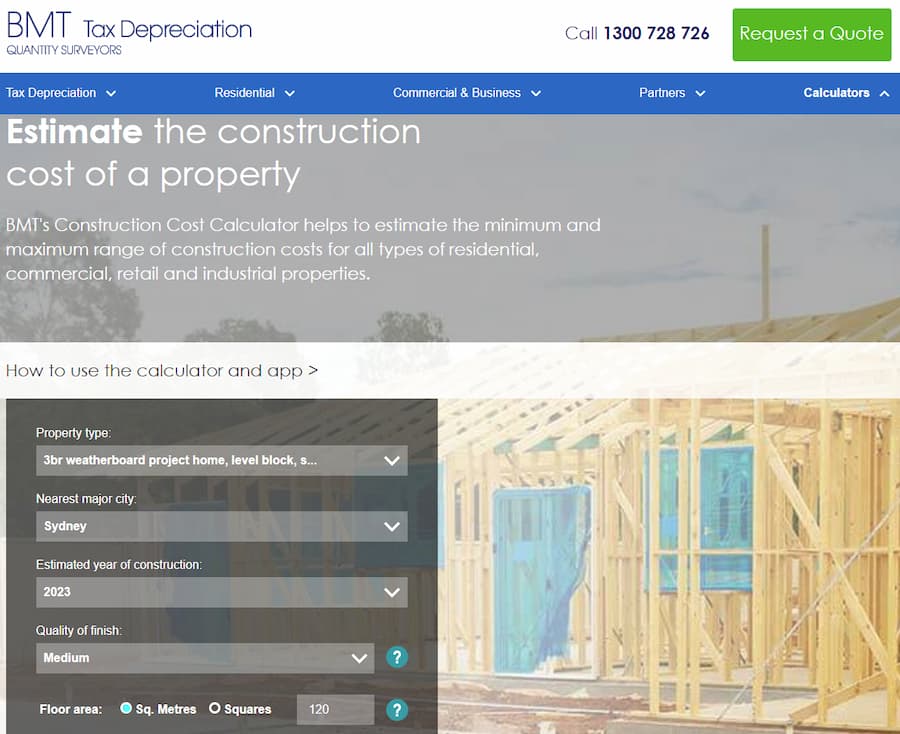

To estimate your construction costs, you can use the Australian online building cost calculator by BMT Tax Depreciation Quantity Surveyors Property Cost Estimator. (While this calculator is for residential housing and not for small granny flats, it can give you an indicative cost based on the floor area square meters. This tool can assist you in determining the total cost of your project based on your location and design preferences).

To maximise returns, it is essential to consider the rental yield of your granny flat. The rental yield is the annual rental income divided by the property’s value, expressed as a percentage. The higher the rental yield, the better the return on your investment. You can also consider refinancing your existing mortgage to finance your granny flat project and potentially get a better interest rate.

A title

Image Box text

To estimate an indicative construction cost try the BMT Tax Depreciation Quantity Surveyors website.

What Are the Tax Benefits of Owning a Granny Flat in Australia?

Owning a granny flat in Australia can provide a number of financial benefits, including tax benefits. If you are interested in maximising returns from your residential property, building a granny flat may be a viable option to consider.

One of the primary tax benefits of owning a granny flat is that it can provide you with additional rental income. By renting out your granny flat, you can potentially earn a significant amount of extra income each month, which can be used to help pay off your mortgage or save for other financial goals.

In addition, owning a granny flat can also provide you with tax deductions. This includes deductions for expenses such as council rates, repairs and maintenance, property management fees, and depreciation of the building. These deductions can help reduce your taxable income, resulting in a lower tax bill.

However, it is important to note that tax laws can be complex and subject to change. To ensure you are receiving all the tax benefits you are entitled to, it is recommended to seek the advice from your accountant or from a qualified tax professional.

To ensure you are building a granny flat that meets all council regulations and requirements, it is important to seek council approval prior to commencing any construction. Additionally, it is recommended to consult with a local mortgage broker or financial adviser to explore financing options, such as refinancing, to help fund the construction of your granny flat.

Further Helpful Links to Home and Investment Loans

We hope you found this blog post helpful in planning your Granny Flat or Second Dwelling project. For more information and guidance, be sure to visit our Neomoney website, which includes additional resources and tools to help you with your mortgage and property investment needs: